Understanding FXAIX and VOO

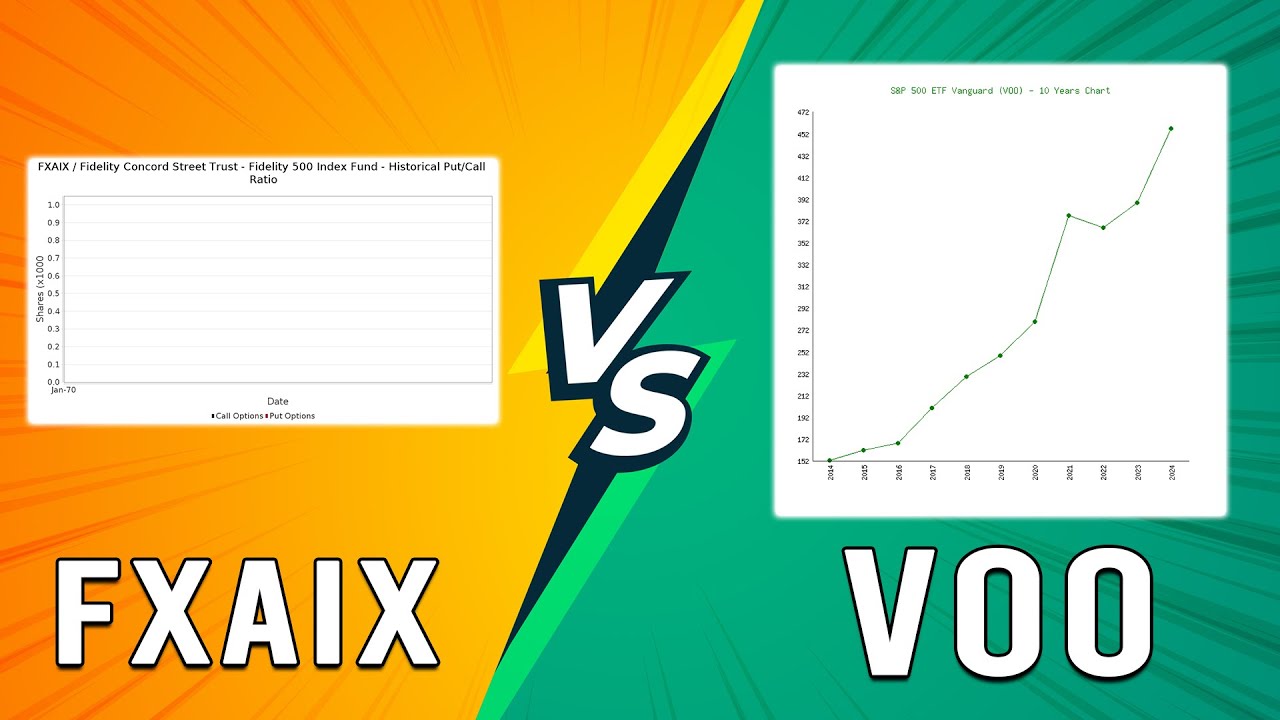

Both FXAIX and VOO track the S&P 500 index, providing diversified exposure to large U.S. companies. FXAIX is a mutual fund from Fidelity, while VOO is an exchange-traded fund (ETF) from Vanguard. Your decision hinges on fees, structure, and personal preferences.

Comparison Factors

Expense Ratio: FXAIX charges 0.015%, lower than VOO's 0.03%, making it slightly cheaper over time.

Fund Type: As a mutual fund, FXAIX trades once daily at net asset value (NAV) and may have a minimum initial investment. VOO, as an ETF, trades throughout the day like a stock, offering flexibility for active investors.

Trading and Accessibility: VOO allows intraday trades and options strategies, while FXAIX is better for automatic contributions in retirement accounts. Consider your broker: FXAIX integrates seamlessly with Fidelity, VOO with Vanguard.

Tax Efficiency: ETFs like VOO often generate fewer capital gains distributions than mutual funds, potentially saving taxes in taxable accounts.

Decision Tips

Use these simple strategies to choose the right fund:

- Assess costs: Prioritize FXAIX for lower expenses if long-term holding, or VOO if fractional shares matter.

- Evaluate account type: Opt for FXAIX in tax-advantaged accounts for automated investing; choose VOO for taxable accounts due to better tax handling.

- Consider convenience: Select based on your brokerage: FXAIX if with Fidelity, VOO if with Vanguard or other brokers.

- Reflect on strategy: If you prefer set-and-forget investing, FXAIX may suffice; for active trading or liquidity, VOO is superior.

Always review expense ratios annually and align with your financial goals.